Report-Celebrations of Insurance Awareness Day-2015 - Policy Holder

Insurance Awareness Day - 2016

Insurance Awareness Day - 2015

Insurance Awareness Day - 2014

- Ranjan's Discovery of Insurance Ombudsman

- Ranjan Brakes for Motor Insurance

- Ranjan Learns More About ULIP

- Ranjan Realises Honesty is the Best Policy

- Ranjan Understands 'Underinsurance'

- Ranjan Can Now Port His Health Policy

- Ranjan Learns About Freelook Period

- Ranjan Fills up The Proposal Form

- Ranjan Learns About Licensed Intermediaries

- Ranjan Learns About Surveyors

- Ranjan Gets Tech Savvy

- Ranjan Learns About Cashless Service

News Items or Important Information for the Customers

Post Launch Survey Report of IRDAI's Insurance Awareness Campaigns(2010-2015)

Report-Celebrations of Insurance Awareness Day-2015

The formation day of Insurance Regulatory and Development Authority of India (IRDAI) was celebrated as Insurance Awareness Day on 19thApril,2015. The Hon’ble Governor of Andhra Pradesh and Telangana, Shri E.S. L. Narasimhan graced the occasion.

Senior officials from insurance industry, other financial sector regulators, NISM,officials from State Government, former Members of IRDAI, insurance Ombudsmen alongwith the staff members of IRDAI and their family members attended the event.

The finals of the In-house Quiz Competition and Pan India Insurance Quiz Competition were also conducted on the day. The team of officers from Agency Department won the IRDAI’s In-house Quiz Competition and the team from Legal Department were the‘runners-up’.

As far as results of Pan India Insurance Quiz Competition are concerned, the participants from Exide Life Insurance Company were declared as ‘winners’ while participants of Reliance General Insurance Company were‘runners-up’.

On the occasion, Chairman IRDAI launched the E-Module for Insurance Brokers’ Training and the booklets on Intermediate Medical Life Insurance Underwriting and AdvanceLife Insurance Underwriting published by Insurance Institute of India.

In the post-lunch session, a panel discussion on Financial Inclusion and Insuranceliteracy was organized. Shri Sandip Ghose from National Centre for Financial Education (NCFE) in National Institute for Securities Management (NISM), Smt. UshaSangwan from LIC of India and Shri Manas Ranjan Mohanty from Reserve Bank of India and Shri D.D. Singh, Member (Non-Life), IRDAI participated and expressed their views. The need for financial inclusion and literacy, government initiatives in providing insurance like Jan DhanYojana, steps taken by insurers for promoting insurance awareness and insurance inclusion, highlights of the financial awareness and inclusion survey conducted by NCFE, steps taken by IRDAI in promoting awareness etc. were discussed.

Shri T.S.Vijayan, Chairman, IRDAI, in his address gave a brief outline about the developments in the insurance sector since opening of the insurance sector for private participation and setting up of IRDAI. He apprised the audience about the challenges before the industry on account of changes in the legal framework consequent upon the enactment of Insurance Laws (Amendment) Act, 2015.

Shri E.S. L.Narasimhan, Hon’ble Governor, in his address appreciated the role of IRDAI in empowering the policyholder through consumer education. However, he suggested that in order to address the insurance policy related issues, the terms and conditions of the policies should be simple and informed upfront so that common man can understand the nuances of an insurance policy without much difficulty. He stressed that the trust that claim would be paid promptly is the main reason for people to take insurance. Though payment of claim is moment of truth, policyholders are facing a lot of difficulties in getting claim amount paid, especially in crop, health and motor insurance. For the farmers who have lost their crop, delay in claim settlement or refusal will create undue hardship. He urged upon insurers to simplify the claim process. He cautioned the insurers that if the sales force remains “dream merchants” they will be failing in their duty in gaining the confidence of the customers which will only cause further damage to the industry. Talking about corporate social responsibility, he advised the industry to consider accepting risks such as providing coverage to police personnel and farmers etc. He also indicated that considering the large number of senior citizens, the insurance companies should focus on insurance products to suit their requirements.

1The occasion was marked by the launch/release of the following consumer education material:-

2Television Commercial cautioning public against spurious callers:-Spurious calls is a menace and IRDAI is making all out efforts to curb the menace using print and electronic media. A TVC Ad was produced by IRDAI as a part of its continuous efforts to educate public cautioning them against spurious callers.

3Facebook Page of IRDAI:-Facebook is the in thing for corporate sector as a part of social media and IRDAI wants to make use of this channel for reaching the public through this platform as well.

4E-Books :-IRDAI has developed a lot of consumer education material. Three books viz. Introduction to insurance; Employment opportunities in insurance sector and Handbook on insurance were converted into e- books to make use of technological platform for dissemination of insurance education.

5IRDAI Brochure and Handbook on Crop Insurance:-This brochure is updation of existing version after the re-naming of IRDAI, handbook on crop insurance is the requirement to cater to the rural segment for insurance education.

6ConsumerAffairs Booklet 2014-15:-The consumer education booklet is a compilation of the grievance redressal data pertaining to various insurance companies and presents analysis of IGMS date for the FY 2014 & 15.

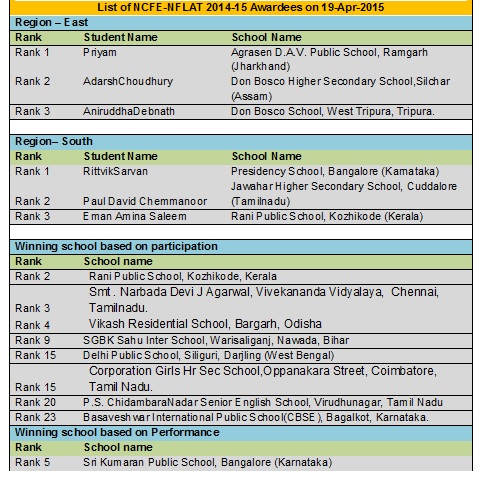

National Centre for Financial Education’s (NCFE) National Financial Literacy Assessment Test (NFLAT) is a first of its kind national level test, conducted to measure the level of financial literacy among school students. Through this test NCFE aims to encourage school students to obtain basic life skills which will help them lead a financially stable and healthy life. Around 1 lakh students appeared in this test. The Chief Guest distributed the prizes to the student and school winners of the NFLAT for East and South regions.

This was followed by cultural programme in which employees of IRDAI and their family members gave performances. The kids of IRDAI’s employees also participated in the fancy dress competition. Folk dance and Kathak dance performances by professional groups were also formed a part of the celebrations. A fashion show by the staff members of IRDAI was the last programme. The audience was enthralled by the performances during the cultural programme.

The entire programme was conceptualised by the Communication Wing with logistic support from Administration Department and enthusiastic participation of the staff member of all cadres.

Click to view the celebrations of Insurance Awareness Day-Photo Gallery